Blog

Latest news from the team

Regenesis

Letting go

The Final Stretch: The Role of Crypto in the 2024 Election

Head of Policy, Rashan Colbert, dives into the role of crypto on the 2024 presidential election.

Say Hello to Prediction Markets

Prediction Markets with leverage are now available on dYdX Chain!

The Return

Antonio Juliano will return to dYdX Trading as CEO. Learn more about the decision.

v3 Product Sunset

We're sunsetting our v3 product to focus on building dYdX Chain software. Learn more.

dYdX Unlimited: Coming This Fall

dYdX Unlimited is coming this Fall! With a whole new range of features that make trading on dYdX Chain Software world class.

Introducing The Market Map

The Market Map from Skip Protocol is expected to come to dYdX Chain later this month. Learn about the next upgrade here.

Deep Dive: MegaVault

Introducing MegaVault: A liquidity solution for dYdX Chain that enables users to deposit USDC and receive yield. Coming soon!

A New Era is Dawning

Head of Policy, Rashan, talks about the upcoming US election and the candidates view on crypto.

DNS Nameserver Hijacking Postmortem

Exploring Strategic Alternatives for v3

Introducing dYdX Chain v5.0

Today dYdX Trading is excited to announce and open source v5.0 of the dYdX Chain software. Check out the blogs for details of the release.

The Vision for dYdX

Newly appointed CEO of dYdX Trading, Ivo Crnkovic-Rubsamen, talks about the vision for dYdX.

dYdX Chain begins Android Beta

dYdX Operations SubDAO has released dYdX Chain on Android. The app will initially release in Beta as user feedback is collected.

The U.S. Should Want DeFi to Flourish: Thoughts on FIT21

As Policymakers are set to vote on FIT21, dYdX Head of Policy, Rashan Colbert, discusses the bill and America's unique position to help DeFi flourish.

Introducing Isolated Markets and Isolated Margin

Take a deep dive into the details of our upcoming release of Isolated Markets and Isolated Margin.

My next step: Founder, not CEO

dYdX Chain v4.0 Release

dYdX Trading is excited to share that v4.0 of our v4 open source software (”dYdX Chain”) has been released! The release includes various feature, risk, governance, and performance upgrades to the protocol.

Introducing LP Vaults

LP Vaults will be available for any cross or isolated market available on protocols using dYdX software, but is especially useful for newer markets that likely have limited liquidity.

2024 Crypto Policy State of the Union

DeFi Policy Principles: A First Principles Approach

Your first reaction may be “Regulation?!?! Impossible, DeFi is just code!!”. To some extent, this is absolutely true. But common sense standards around things like self custody, disclosures, and security will make DeFi safer and more accessible to all.

Launch Incentives Season 1 Distribution

Chaos Labs’ governance proposal for season 1 has passed governance vote and will result in the distribution of $5M in rewards to traders!

2024 Product Roadmap

We are excited to share an updated product roadmap for 2024 that will continue to drive innovation in DeFi! This year we will focus on building software to support Permissionless Markets, improve Core Trading, and upgrade UX/onboarding.

dYdX Chain Available for iOS

dYdX Chain is now available for iOS in certain regions!

Fiat Onramp to dYdX Chain with Kado

We’re excited to share that Kado has enabled support for direct fiat onboarding to dYdX Chain. Traders can now buy USDC using Kado when onboarding in less than 5 minutes via debit/credit card or bank transfer.

DeFi is Novel Technology that Requires Unique Rules

Some government agencies are opting for “regulation by enforcement,” seeking to overlay rules and regulations designed for the traditional financial markets onto DeFi. We can’t force new ideas into old models; regulation must adapt when technology evolves.

Post Mortem on SUSHI and YFI Incident

Read the research our team did to understand the attack on the dYdX v3 insurance fund.

2023 Year in Review

As another year comes to a close, let’s reflect on where we have come from and look forward to 2024.

Thoughts After the Deputy Treasury Secretary’s Address

Head of Policy, Rashan Colbert, comments on the Deputy Treasury Secretary's Address to the Blockchain Association

v3 Testnet Migration

Updates on dYdX Chain

Summarizing key updates on dYdX Chain from the last two weeks

Introducing dYdX's Open Source Design System

Introducing dYdX open-source design system! Try it out.

A New Architecture to Mitigate MEV

Dive into our new architecture created to mitigate MEV.

Announcing CCTP on Noble - Enabling Easy Access to USDC

Circle’s Cross-Chain Transfer Protocol (CCTP) on Noble enables users to send their USDC from other chains directly to dYdX Chain in an easy, simple and secure manner

It’s Finally Here: dYdX Chain v1.0 is Officially Released!

We’re happy to share that today marks the official v1.0 production open source release of the dYdX Chain code!

Understanding Front End Safety

Always do your own due diligence before connecting your wallet to a dYdX Chain interface

dYdX Trading - A Public Benefit Corporation

dYdX Trading has officially updated its charter to become a Public Benefit Corporation. In addition to all of our work on v4, this further establishes our commitment to aligning with the builders, traders, and stakeholders in the web3 community.

Dive Into The dYdX Chain Audit

The upcoming dYdX Chain has been fully audited by Informal Systems. Take a look at the audit details in this blog.

Distinguishing MEV from Expected Noise

The dYdX Research team has worked with Skip Protocol to update Skip's MEV dashboard to better account for latency and regular network noise.

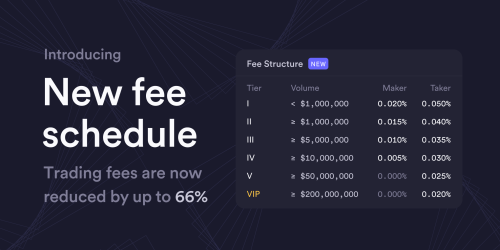

v3 Updated Fee Schedule

$DYDX v3 fee discounts will be winding down on September 29.

The Evolution of the Trading Interface

Take a look back in time and into the feature at the evolution of the dYdX trading interface.

dYdX x Squid x Axelar - 1-Click Onboarding

We've partnered with Axelar and Squid to make user onboarding as easy as possible on v4. Users can deposit or withdraw to and from a dYdX Chain address in one single click. Learn more in this blog post!

Securing the dYdX Chain: Announcing our Bug Bounty Program

The dYdX Chain bug bounty program is now live! Help us make the dYdX Chain even more secure and participate in our bug bounty program.

Introducing the dYdX Chain Open-source Code

As part of our commitment to decentralization and transparency all dYdX Chain core repositories are now public on GitHub.

Public Testnet 2 Update

dYdX will be winding down Testnet 2 on September 11th at 15:00 UTC to prepare for the launch of Testnet 3.

dYdX Reaches $1 Trillion in Trading Volume

On July 14th, dYdX reached $1 trillion in total trading volume! Thank you to all the traders and community members that have supported our protocol. We look forward to an even brighter future as we approach the release of our v4 open-source software.

UK User Requirement Update

Due to certain regulations in the United Kingdom, dYdX Trading Inc. is updating our United Kingdom user requirements.

Public Testnet Update

We will be sunsetting the current version of our testnet on August 7th at 17:00 UTC to reset and relaunch the public testnet on August 10th 17:00 UTC. The testnet will be unavailable while these upgrades are being made.

v4 Deep Dive: Rewards and Parameters

This post discusses characteristics of the open-source software and the related governance token. Please note that each of the topics discussed below is subject to change by the applicable governance community (the “Governance Community”).

An update on MEV - Catching a Bad Validator

In order to discourage MEV extraction, Skip Protocol developed a dashboard that highlights the amount of MEV each validator potentially has extracted. We are dedicated to building open-source mechanisms and protocol level designs to deter MEV extraction.

Financial Innovation and Technology for the 21st Century Act

This week, the United States Congress took historic steps when the House Financial Services and House Agriculture Committees moved bipartisan crypto-focused legislation: the ‘Financial Innovation and Technology for the 21st Century Act.’

Public Testnet (v4 Milestone 4 is Complete)

The dYdX Chain public testnet is set to launch on 7/05/2023 at 17:00 UTC! Read this blog post for further details and timelines. Happy testing!

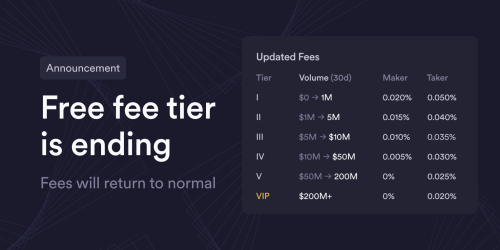

Free Trading is Ending

On June 27th at 16:00 UTC, free trading came to an end. We hope that you’ve enjoyed the lower fees and taken advantage of them over the past year!

v4 Deep Dive: Governance

This post presents a deep dive into v4 Governance. The dYdX Chain open source software will include certain required parameters of the governance module. However, dYdX Trading will not suggest or lead on-chain nor off-chain governance processes!

v4 Deep Dive: Front End

This post dives into how the dYdX v4 chain’s front end will work. dYdX will open source all front end codebases and associated deployment scripts. This will allow for anyone to easily deploy the dYdX front end via their own domain/hosting solution.

v4 Deep Dive: Indexer

This post presents a deep dive into the Indexer. The Indexer is a read only layer that exists between the chain itself and end users. The Indexer’s purpose is to translate and serve data in an easier to use format.

v4 Technical Architecture Overview

We want to provide a peek into what the dYdX team is building. This post presents a high-level overview of the architecture of V4.

dYdX Named Among Best Workplaces

dYdX is proud to have been named to Inc. magazine’s annual Best Workplaces list for 2023!

Why Decentralization Matters

Understanding the benefits and trade-offs of decentralized systems is essential to crafting policies that will adequately protect consumers while allowing innovation to progress in a positive manner. Read more about why decentralization matters here.

Canada Wind Down

dYdX is winding down user access from Canada. We realize that this restriction may be disruptive to certain users and regret any inconvenience.

dYdX v4 and MEV

Rebuilding dYdX as a standalone Cosmos based blockchain featuring a fully decentralized, off-chain, orderbook and matching engine.

Updated Tick Sizes for ALGO, NEAR, & SNX

We have reduced tick sizes by a factor of 10 for the ALGO, NEAR, and SNX markets.

v4 Milestone 3 is Complete

The dYdX Private Testnet is set to begin on 3/28/2023 and will last 2-3 weeks. Read this post for further details and timelines!

Fast Withdrawal Update

An update regarding Fast Withdrawals on dYdX. All funds remain safe and fully auditable on-chain.

Crypto Review Ahead of the State of the Union

As President Biden prepares to address the nation and the members of the 118th Congress with his State of the Union speech, this article reviews the last year in crypto and highlights the big ideas and events that will drive the conversation in 2023.

Introducing dYdX's New Head of Policy: Rashan Colbert

dYdX is proud to announce that Rashan Colbert has joined our team as the Head of Policy.

NPM Package Post Mortem

Post mortem is that we had a phishing attack and confirmed all of our initial findings (i) funds safe, (ii) website/apps were not compromised, and (iii) attack did not impact smart contracts.

Increased IMF for Select Markets

We have increased IMF to 20% for the following markets: 1INCH, CELO, COMP, ENJ, MKR, RUNE, SNX, and UMA.

v4 Milestone 2 is Complete (Updated 1/17/23)

The purpose of Milestone 2 was to complete all of the basic functionality needed to run the core product of the V4 exchange.

Introducing Swap Mode

Trade perpetuals with a familiar yet powerful UI. Live on the dYdX iOS app

Updated Tick Sizes for ATOM, CRV, & MATIC

We have reduced tick sizes by a factor of 10 for the ATOM, CRV, and MATIC markets.

Fiat On-Ramp

We now provide dYdX users a tool to purchase USDC using a variety of payment methods including credit card, bank transfer, and other convenient local payment methods.

Game Theory with Jordi Alexander

Episode 5 of the dYdX podcast: Depth and Spread is live! In this episode, we chat with Jordi Alexander, CIO of Selini Capital.

Staging Testnet Migration to Goerli

At 2022-09-12 15:00 UTC, we will be turning down our exchange services running on the Ropsten Testnet. In place of this, we will be launching our exchange on the Goerli Testnet. Please note that accounts, balances, and positions will NOT be migrated over.

Trading Leagues Update

Starting Season 34, on September 13th, 2022, USDC rewards will no longer be included in the Trading Leagues prize pool. Trading Leagues will still remain available for all users as will the distribution of Hedgie prizes.

The Merge Update

We do not expect any disruptions to trading or withdrawals during "The Merge". As a precaution, we will pause the confirmation of deposits until The Merge event is completed. Additionally, all exchange-related bonuses will be delayed.

Anatomy of a Trade with CMS

Episode 3 of the dYdX podcast: Depth and Spread is live! In this episode, we sat down with Dan Matuszewski, Founder of CMS Holdings.

$25 Deposit Bonus

We are excited to share that every new dYdX user that deposits 500 USDC or more on their first transaction is now eligible to receive a one-time deposit bonus promotion of 25 USDC

Tornado Cash Update

dYdX has updated our compliance checks in partnership with our compliance partner to account for recent developments, and dYdX is currently blocking less than 0.1% of wallets connected to the exchange.

v4 Milestones

Employee Referral Program

dYdX's employee referral program is now live. Send us your high quality referrals and if we hire them, you will receive $15,000!

Tornado Outage

We were recently made aware of an issue related to Tornado that was causing many wallet addresses to be blocked from accessing our exchange. We have rectified this and you can read the full announcement here.

Free Trading

We’re excited to be the first crypto exchange to offer truly free trading* for up to $100k in volume per month to all users, across all markets.

v4 AMA with Antonio

Antonio touches on v4 product features, company plans, Android app, governance, and much more!

Frontier Markets with Mitchell Dong

Episode 2 of the dYdX podcast: Depth and Spread is live!

Reduce-Only Orders and Increased Maximum Position Sizes

We have added Reduce-Only orders and increased maximum position sizes!

Legends Competition: Survival of the Bear

We are excited to announce our first Legends Competition – a trading competition for crypto influencers to compete against one another for cash prizes and bragging rights!

Announcing dYdX Chain

Rebuilding dYdX as a standalone Cosmos based blockchain featuring a fully decentralized, off-chain, orderbook and matching engine.

A message from dYdX

While 3AC invested in dYdX, our liquidity and exchange operations will not be affected by current or future developments involving them.

Trading Through the Terra Crash

We are pleased to announce the launch of our new podcast series: Depth and Spread.

Our Company Values

Think 10x bigger. A players only. Act like a founder. Ruthlessly prioritize impact. Decentralize through transparency. Move fast.

Building Intuitions Around Leverage

How should one think about leverage in crypto?

XTZ now live

TRX now live

Fee Holiday is Back

dYdX for iOS is here

ICP now live

We are excited to share that ICP-USD is now live. Start trading Internet Computer (ICP) today on dYdX, with up to 10x leverage.

CELO now live

We are excited to share that CELO-USD is now live. Start trading Celo (CELO) today on dYdX, with up to 10x leverage.

RUNE now live

We are excited to share that RUNE-USD is now live. Start trading THORChain (RUNE) today on dYdX, with up to 10x leverage.

Fee Holiday Ending

On April 19th, the dYdX fee holiday will be coming to an end.

LUNA & NEAR now live

We are excited to share that LUNA-USD and NEAR-USD are now live. Start trading Terra (LUNA) & Near (NEAR) today on dYdX, with up to 10x leverage.

ETC now live

We are excited to share that ETC-USD is now live. Start trading Ethereum Classic (ETC) today on dYdX, with up to 10x leverage.

XLM now live

We are excited to share that XLM-USD is now live. Start trading Stellar (XLM) today on dYdX, with up to 10x leverage.

dYdX iOS Beta

Starting today, the public beta period will allow loyal traders to experience a best-in-class interface before the general release.

ENJ now live

We are excited to share that ENJ-USD is now live. Start trading Enjin (ENJ) today on dYdX, with up to 10x leverage.

Content Competition Winners

Thank you to everyone who participated in our first content competition - come check out the winning submissions!

Introducing Hedgies

dYdX is excited to unveil Hedgies, a collection of 4,200 unique collectible avatars that will be distributed to our community.

Introducing Trading Leagues

Trading Leagues is a first of its kind product that enhancing the trading experience and rewards traders with weekly prizes.

Fee Reduction Holiday

As of Jan 18th, the dYdX fee schedule has been reduced across the board for a minimum of three months.

Maximum leverage reduction to 20x

On January 14th, the maximum initial leverage available on BTC and ETH will be reduced to 20x.

dYdX v4 - Full Decentralization

Announcing dYdX V4 - the next version of our protocol, fully decentralized. Coming 2022.

Deposit Contract Post Mortem

On November 27th around 05:00 UTC, we were notified of a critical vulnerability in on of our smart contracts.

Trading Competition #2

We are excited to share that dYdX’s second trading competition will run from December 9th to December 16th.

Gasless deposits now live

dYdX is excited to offer gasless deposits and seamless 0x swaps for a greatly improved onboarding experience.

Content Competition

Earn rewards for creating visual and informative content based on a prompt of your choice.

ZRX now live

We are excited to share that ZRX-USD is now live. Start trading 0x (ZRX) today on dYdX, with up to 10x leverage.

ALGO now live

We are excited to share that ALGO-USD is now live. Start trading Algorand (ALGO) today on dYdX, with up to 10x leverage.

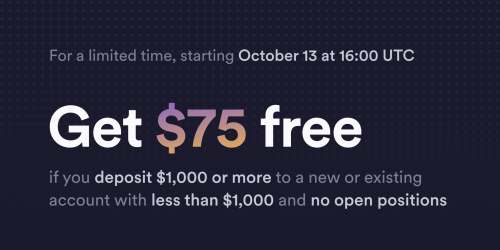

Deposit bonus promotion

For a limited time, new accounts and accounts with less than or equal to 1000 $USDC account value are eligible to receive a 75 $USDC bonus.

ZEC now live

We are excited to share that ZEC-USD is now live. Start trading Zcash (ZEC) today on dYdX, with up to 10x leverage.

Layer 1 Wind Down

We will be winding down dYdX Layer 1 spot trading, margin trading, and borrowing on November 1, 2021 at 18:00 UTC.

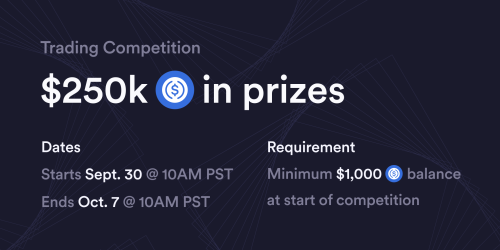

Trading Competition #1

We are excited to share that dYdX’s first trading competition will run from September 30th to October 7th.

XMR now live

We are excited to share that XMR-USD is now live. Start trading Monero (XMR) today on dYdX, with up to 10x leverage.

BCH now live

We are excited to share that BCH-USD is now live. Start trading Bitcoin Cash (BCH) today on dYdX, with up to 10x leverage.

EOS now live

We are excited to share that EOS-USD is now live. Start trading EOS (EOS) today on dYdX, with up to 10x leverage.

Introducing the dYdX Foundation

The dYdX Foundation is focused on fostering decentralized governance & empowering traders with powerful, transparent, and open products.

Hummingbot Bounty Hunt

We are happy to announce a new round of bounties to challenge the Hummingbot developer community! Get started on Hummingbot today.

LTC now live

We are excited to share that LTC-USD is now live. Start trading Litecoin (LTC) today on dYdX, with up to 10x leverage.

Market Making on dYdX

We hosted a debate with Delroy Fong (Amber Group), Darius Sit (QCP Capital & Phillip Street Partners), and Su Zhu (Three Arrows Capital).

COMP now live

We are excited to share that COMP-USD is now live. Start trading Compound (COMP) today on dYdX, with up to 10x leverage.

ATOM now live

We are excited to share that ATOM-USD is now live. Start trading Cosmos (ATOM) today on dYdX, with up to 10x leverage.

ZK vs. Optimistic Rollups

We hosted a debate with Antonio Juliano (dYdX) and Kain Warwick (Synthetix) that was moderated by Dan Robinson (Paradigm).

Wootrade / Kronos AMA Recap

On June 22nd, we hosted a live AMA Spotlight with Ran Yi, COO at Kronos Research & Wootrade and Ben Yorke, VP of Marketing at Wootrade.

ADA now live

We are excited to share that ADA-USD is now live. Start trading Cardano (ADA) today on dYdX, with up to 10x leverage.

FIL now live

We are excited to share that FIL-USD is now live. Start trading Filecoin (FIL) today on dYdX, with up to 10x leverage.

MKR now live

We are excited to share that MKR-USD is now live as our 17th market. Start trading Maker (MKR) today on dYdX, with up to 10x leverage.

Liquidation reload promotion

For a limited time, any dYdX Layer 2 account that has ever had a position liquidated is eligible to receive a 75 $USDC deposit bonus.

dYdX Closes $65M Series C

We’re excited to announce that dYdX has raised a $65M Series C round led by Paradigm!

MATIC now live

We are excited to share that MATIC-USD is now live as our 16th market. Start trading Polygon (MATIC) today on dYdX, with up to 10x leverage.

Bitlink AMA Recap

We hosted an AMA with Yang Li of Bitlink Capital, where we discussed hedged vs. non-hedged market maker strategies and more.

DOT now live

We are excited to share that DOT-USD is now live. Start trading Polkadot (DOT) today on dYdX, with up to 10x leverage.

UMA now live

As we close in on $2B in cumulative volume on our Layer 2 Perpetuals, we are excited to share that UMA-USD is now live as our 14th market.

Deposit bonus promotion

For a limited time, all users are eligible to receive a 50 $USDC deposit bonus after a deposit of at least 1000 $USDC to Layer 2.

CRV now live

As we close in on $1.8B in cumulative volume on our Layer 2 Perpetuals, we are excited to share that CRV-USD is now live as our 13th market.

Sixtant AMA Recap

In the latest addition to our AMA series focused on market making, Josu and Matt from Sixtant discuss market color on dYdX, market making strategies, the future of market making in DeFi, and more.

SNX now live

As we close in on $1.3B in cumulative volume on our Layer 2 Perpetuals, we are excited to share that SNX-USD is now live as our 12th market.

Wintermute AMA Recap

In April, we hosted an AMA with Evgeny Gaevoy, Founder & CEO and Yuriy Myronovych, Head of DeFi from Wintermute to discuss market making strategies.

DOGE now live

As we approach the $1B mark in cumulative trading volume on Layer 2, we are excited to share that DOGE-USD is now live as our 11th market.

AVAX now live

As we close in on $750M in cumulative volume on our Layer 2 Perpetuals, we are excited to share that AVAX-USD is now live as our 10th market.

StarkWare AMA Recap

In April, Ohad Barta and Brendan Chou discussed why dYdX chose StarkWare as their Layer 2 solution, how StarkEx works, the vision behind StarkNet, and more.

Deposit bonus now live

We are making it even easier to get started with dYdX. For a limited time, all new users are eligible to receive a 50 $USDC deposit bonus after their first deposit to Layer 2.

YFI, 1INCH now live

As we approach $500m in total volume, and over 10,000 trades, we are adding YFI-USD and 1INCH-USD Perpetual Contracts, available with up to 10× leverage in eligible regions.

SOL, SUSHI now live

We have added SOL-USD and SUSHI-USD Perpetual Contracts with up to 10× leverage in eligible regions. We will continue to list new markets regularly.

UNI, AAVE now live

Less than a week after our launch, we have added AAVE-USD and UNI-USD Perpetual Markets, available today to eligible traders, featuring up to 10× leverage.

Trade now on Layer 2

After testing & improving our Layer 2 system with our community over the last few weeks, it is now live in production featuring zero gas costs, lower trading fees & small minimum trade sizes.

Join the Layer 2 Alpha

Sign up for the Alpha to start trading on Layer 2 with low fees, instant settlement, and up to 25× leverage. Our new cross-margined Perpetuals system is built in collaboration with StarkWare.

Meet the brand

We took the last few months to revisit our visual identity. Introducing our new brand, homepage, and trading interface – all redesigned from the ground up to maximize the trading experience.

Announcing our Series B

We’re excited to announce that dYdX has raised a $10M Series B round led by Three Arrows Capital and DeFiance Capital, with support from new and existing investors around the world.

2020 in Review

It was a huge year for dYdX. We built and launched our first protocol for Perpetual Contracts, saw many thousands of new traders use dYdX, and increased our trade volume by 40x.